Crypto Regulation 2025 Introduction:

Think of crypto like a big playground where kids trade shiny rocks as money. For years, there were no clear rules, so some rocks got lost, or bad kids tricked others. But in 2025, the grown-ups – like the US government – stepped in with new guidelines to make the playground fair and fun. These crypto regulation 2025 changes are like adding fences and referees. They help protect your rocks while letting everyone play. Let's walk through it step by step, using easy words, so even young kids can get it. We'll cover what happened, why it matters, and how it fixes your everyday worries.

First off, the biggest news is the GENIUS Act. President Trump signed this law on July 18, 2025. GENIUS stands for Guiding and Establishing National Innovation for U.S. Stablecoins. Stablecoins are special cryptocurrencies that stay worth one dollar, like a steady rock that doesn't roll away. Before this law, anyone could make them, and sometimes they weren't backed by real money. Now, companies must follow strict steps to make and sell them in the US.

Here's how the GENIUS Act works:

Companies, called issuers, have to keep 100% real money or safe things like short-term government bonds for every stablecoin they make. It's like having a piggy bank full of dollars for each digital dollar. They must tell everyone every month what's in that piggy bank – how much cash, where it's kept, and more. No hiding! If something goes wrong, like the company closes, stablecoin owners get their money back first, before anyone else.

The law also fights bad stuff. Issuers must check for money laundering, just like banks do. They have to know who their customers are and watch for sneaky tricks. If the government says freeze some coins because of a crime, the company must be able to do it. No more letting bad guys use crypto to hide. Plus, they can't lie and say the government backs their coins – that's against the rules, with big fines up to $500,000 per lie.

Why did this happen in 2025?

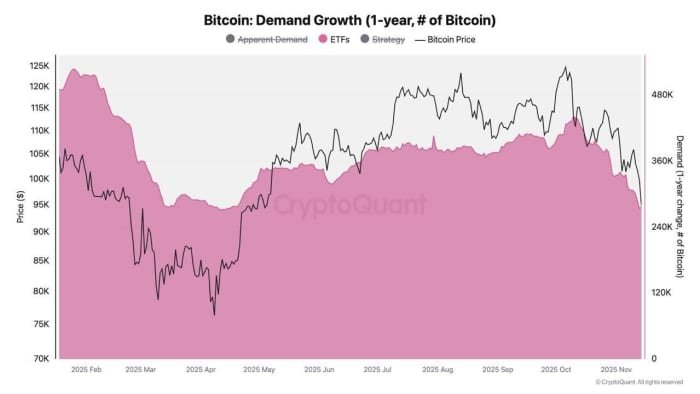

President Trump wants America to be the "crypto capital of the world." He started early. Right after taking office in January 2025, he signed an order to boost digital money leadership. Then in March, another order created a Strategic Bitcoin Reserve – like a national savings jar for Bitcoin. The US won't sell its Bitcoin and might even buy more. This shows the government sees crypto as valuable, not just risky.

Trump's team also set up a Crypto Task Force. By August 2025, they dropped or froze about 89 old cases against crypto companies. That's a big change from before, when regulators were tough. It means less fighting and more building new things.

Speaking of regulators, the SEC – the main watchdog for money rules – made a key move in November 2025. They said for 2026, they're not focusing as hard on checking crypto companies. In past years, crypto had its own big section in their plans, warning about tricks and ups and downs. Now, it's mixed in with other stuff like keeping customer info private. The new SEC boss, Paul Atkins, says checks should help companies talk and fix things, not just catch mistakes. Crypto fans like this because it feels friendlier, especially with Trump in charge.

But is everything perfect? Not yet. Some experts talk about joining the SEC with another group, the CFTC, which watches things like farm goods and now some crypto. Merging them could create a single team for all digital money. Why? Right now, it's confusing – is a coin like a stock (SEC) or like wheat (CFTC)? A merged group could make decisions faster and create rules that better fit. It would help stop bad money moves and let new ideas grow. In 2025, laws like the Clarity Act and the Responsible Financial Innovation Act push for this, but it's still being talked about.

Around the world, other places are updating too. Europe has MiCA rules that started strong in 2025, making companies get licenses and protect users. India made taxes fairer on crypto trades. Switzerland gave new okay's for stablecoins. These global changes help because crypto doesn't stop at borders. For US folks, it means your apps might work better with international friends.

Also Read This:

Survey of Bitcoin News 2025: The November Crash and Paths ForwardEthereum Updates 2025: Upgrades, Price Trends, and Future PotentialNow, let's solve some common problems you might have:

Worry 1: "Is crypto legal now?" Yes! The GENIUS Act says stablecoins are okay if they follow rules. Other crypto isn't banned – it's just clearer.

Worry 2: "What about taxes?" New guidelines make reporting easier. If you buy or sell, apps must help track it, like banks do.

Worry 3: "Can I lose everything in a hack?" Safer reserves and checks mean less risk, but always use strong passwords and trusted wallets.

Worry 4: "Does privacy go away?" Some rules need your name for big deals, like at a store, but small stuff stays private. It's to catch crooks, not spy on you.

For businesses, these rules open doors. Companies can now make stablecoins without fear of sudden stops. Big names like banks might join, making crypto as easy as using a card. But non-money companies, like tech giants, need extra okay's to play, and they can't use your info for ads without asking.

Looking ahead, 2025 might bring more. The Treasury asked for ideas in August on how the GENIUS Act works, like costs and privacy fixes. By 2026, we could see rules for other crypto, not just stablecoins. Experts say this could grow the market to trillions, but with care for the environment and fair play.

Main Parts of the GENIUS Act:

| Part | What It Does | Why It Helps |

|---|---|---|

| Reserves | Keep a full real-money backup | Stops coins from losing value |

| Disclosures | Tell everyone the monthly details | Builds trust, no secrets |

| Anti-Bad Stuff | Check for crimes, freeze if needed | Keeps out cheaters |

| Marketing Rules | No fake claims of government help | Avoids tricks on users |

| Penalties | Fines and stops for breaking rules | Makes everyone follow |

Trump Crypto Moves in 2025:

| Month | Action | Impact |

|---|---|---|

| January | EO for digital leadership | Sets a friendly tone |

| March | Bitcoin Reserve EO | US holds Bitcoin as treasure |

| July | Signs the GENIUS Act | Regulates stablecoins safely |

| August | Task Force drops cases | Fewer fights with companies |

| November | SEC eases checks | Focus on help, not just catches |

Conclusion:

In the end, crypto regulation 2025 is like turning a wild park into a safe garden. It keeps the excitement but adds paths and signs. Whether you're a kid with a few coins or a grown-up building apps, these changes make digital money stronger for all. Stay curious, check official sites, and enjoy the ride!